What Political Parties (and Brands) can learn from Consumer Search Behaviour related to the UK General Election

Today, millions of UK voters have headed to the polls to cast their votes and shape the nation’s future. But what can the shifts in consumer search behaviour tell us about what voters—and indeed consumers—have on their minds as they head to the polls, and what can brands learn from this?

We’ve delved into our vast array of onsite search data to uncover the most significant trends observed in the run up to the election, based on search interest, which both brands, and it seems political parties, should be aware of.

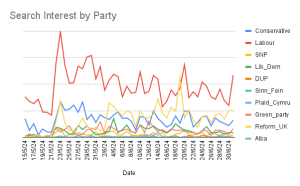

Labour Sees a 235% Uplift in Search Interest the Day After Election Announcement

After the election was announced on May 22, we witnessed the first seismic changes in voter interest. While all parties experienced increased search interest, searches for Labour surged by 235% the day after the announcement compared to the preceding week’s daily average, far exceeding interest in any of the other parties.

However, perhaps the most significant change to the landscape was still to come. On June 3, Nigel Farage entered the election race, triggering an immediate impact on search. Reform surged into second place in terms of search interest—a position they have largely maintained ever since. Interest peaked following the launch of their manifesto, briefly surpassing searches for Labour on that day before settling back into second place.

What Do Voters Actually Care About, And Have The Parties Addressed The Right Issues?

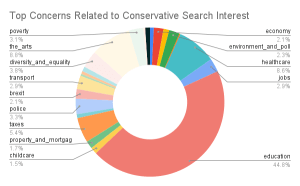

While tax remains an important consideration for Conservative voters, education and healthcare garner higher search interest—potentially due to concerns around Labour’s proposed plan to introduce a 20% VAT hike on independent schools.

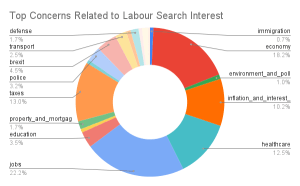

In contrast, Labour related searches are focused on economic issues like employment, inflation, interest rates, echoing the sentiment of “it’s the economy, stupid” famously coined across the Atlantic. Healthcare and the NHS are important areas of search interest around Labour, although searches related to the NHS lag behind those concerning tax policies. This reflects the impact of Rishi Sunak’s warnings on potential Labour tax increases.

In contrast, Labour’s ‘Tory mortgage cost’ counterattack failed to gain traction. Although there was a modest 1.14x uplift in searches around mortgage costs on the day of the announcement, interest quickly returned to normal levels the next day.

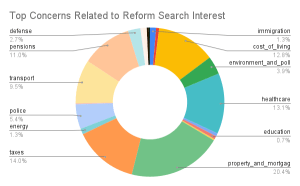

Lastly, data around Reform reveals a narrative beyond the media spotlight on immigration—with searches around personal affordability at the forefront. The impact of the cost of living crisis is clear, with search interest focusing on financial struggles, mortgage costs, and taxes, as well as essential public services like transport and policing.

Which Audiences are Interested in Which Party?

Audiences associated with Labour and Conservatives searches are less likely to deviate too far from the status quo. Top indexing audiences for Conservatives include business professionals, c-suite, entrepreneurs, older parents and pensioners. For Labour, interests such as gender equality and eco-consciousness index highly, alongside audiences such as new parents and millennials. Notably, the presence of business professionals related to Labour searches reinforces the central role of economic issues in this election.

In contrast, Reform has garnered support across diverse audiences. There is significant interest in pensions, particularly among grandparents (index 2.81x higher than our network baseline)—as well as students (12.54x), workers (7.86x), sports fans (3.09x), and parents (1.98x).

The State Of Play Entering Election Week

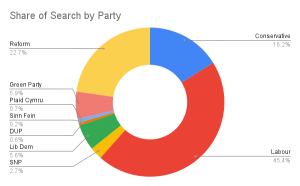

In the final days of the campaign, Labour’s search interest has surged significantly, now over 3.5 times that of the Conservatives, and more than double that of Reform. This marks a notable increase in the gap between Labour and the parties, following a period of convergence over the past few weeks.

Recent search data shows Labour commands a 29-point lead in share of search over the Conservatives. Meanwhile, Reform maintains a daily search volume 55% higher than the Conservatives, the Conservatives trail Reform by 6.5 points in share of search, reflecting search interest in exploring alternative options.

Despite Ed Davey’s highly-publicised campaign stunts, search data suggests these efforts may have fallen short, with the Liberal Democrats not seeing any significant increases in search despite the publicity driven by these stunts. In contrast, the Green Party has seen increased search interest, indicating growing consideration among voters seeking a progressive vote.

So, What will Happen?

Using Captify’s geo segments, we mapped our data to postcode-level constituencies, and comparing it with the results of the 2019 election, to forecast likely outcomes.

Our analysis suggests a challenging landscape for the Conservatives, with limited optimism for Reform and the Liberal Democrats as well.

In contrast, Labour appears poised for success, with our data predicting a potential majority of 217 seats. Want to learn more about this? Just get in touch.

The Power of Search Data Signals

Just like an election campaign, brands can benefit from measuring and understanding the impact of their messaging and campaign activity through real-time changes in search behaviour.

Search data represents the most powerful dataset for understanding and predicting the needs, desires, and behaviours of the audience brands are trying to reach—insights that surveys and polls fall short of capturing. This real-time data allows brands to seize real-time opportunities for relevant, meaningful, and effective connections.

To understand how cultural moments are shaping consumer behaviour around your brand, get in touch.

*Data sourced from Captify’s UK network from 15/05/24 to 01/07/24